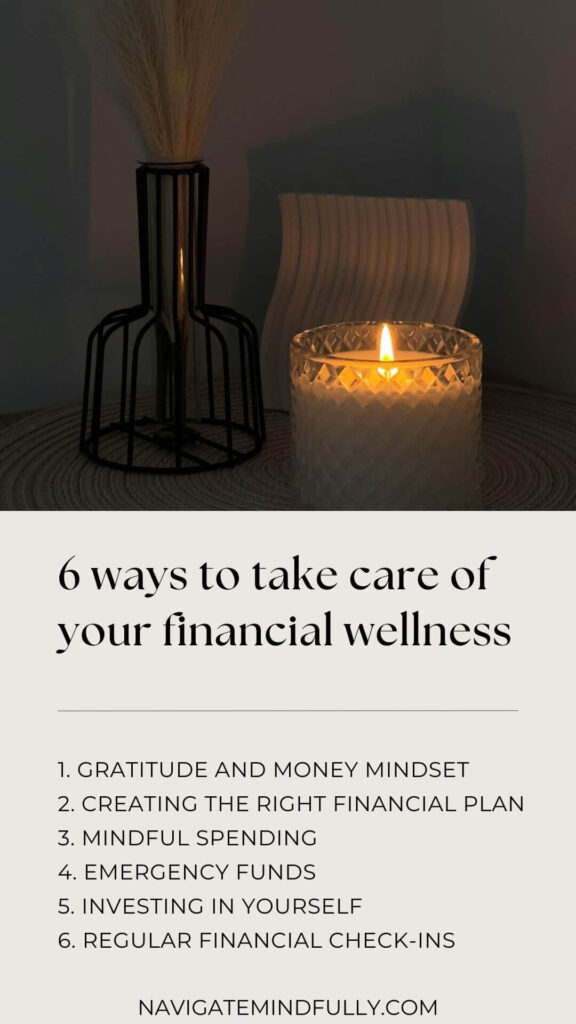

6 Ways to Take Care of Your Financial Wellness

Wellness doesn’t only cover mental and physical. There are loads of different aspects of wellness for you to be mindful of like emotional, spiritual, social, occupational, and many more but today, we’re focusing on financial wellness. It often falls to the bottom of the list of priorities and simply isn’t talked about enough!

What is Financial Wellness

So, what is financial wellness? In short, it’s having a healthy relationship with your finances – that includes being intentional about what you do with your money, managing it well, being able to meet all of your financial obligations, and feeling secure.

Taking a holistic approach means making changes to your lifestyle as a whole – not just what you do with your money and how much you spend, but looking at things like gratitude practice and mindful spending too.

There are many ways to get yourself on the right track to head towards financial wellness, but in this post, let’s take a look at 6 ways you can practice financial self-care.

6 Ways to Practice Financial Self-Care

1. Gratitude and a Positive Money Mindset

Before you can do anything else, the first step to achieving financial wellness is a change in your mindset. Practicing gratitude changes how you perceive your finances creating a more positive mindset about money that sets the tone for all of your other financial habits. Changing the way you think about something, is the foundation.

Trying to build better habits on top of a shaky foundation will mean those habits won’t last. So weed out the limiting beliefs you have before you start planning and goal setting for being an absolute boss in the finance department!

Why does gratitude matter?

It’s an essential part of any wellness practice – it helps you focus on what you have rather than focusing on what you lack, which then creates a feeling of contentment and excitement about how your life already is.

Focusing on what you do have increases good feelings and reduces your stress levels, which in the long run makes it easier to make mindful decisions about your finances. When you’re able to appreciate the things that you have already, you create a feeling of abundance which we know will attract more abundance.

Gratitude practice is pretty simple, but actually very impactful! You can do it through journaling and writing down all the things you’re grateful for each day or having intentional moments of reflection on all the things you have and are blessed with. Furthermore, you can express it in the moments when you’re buying things, for example when you’re getting your latte before work, take a moment to be a little more grateful than you normally would.

2. Budgeting: Creating a Financial Plan That Feels Right

Budgeting… I bet you rolled your eyes after reading that title, but budgeting isn’t the restrictive or overwhelming thing that you think it is. It seems to have a bad rep, but it is actually key in getting your spending in check, paying off any debts, and hitting saving goals.

Your budget doc doesn’t need to be fancy, just open up a spreadsheet and list down all of your incomings and your outgoings, then create an amount for how much you want to save and how much you want to spend in the month, and work to that the best you can.

Don’t worry if you’re over or under budget in a month, you’re only human and whilst you’re still trying to find your footing in your financial wellness journey you’re definitely going to make mistakes! If you go over budget one month just try your best at being under budget the next month to get you back on track.

When you achieve the goals you set out to even if it is just a budget, the sense of accomplishment is so great it’s sure to get those endorphins pumping. If you don’t know where to start here are a few budgeting methods you can try:

- Zero-Based Budgeting

- 50/30/20 Rule

- Envelope System

3. Mindful Spending: Align Your Purchases with Your Values

Mindful spending is all about making buying decisions that mirror your actual values and goals, rather than impulse buying. By aligning your spending habits with what truly matters to you, you’ll be able to create a more fulfilling relationship with your finances and build a life that feels secure and definitely less stressful!

Take some time to really understand your values and pinpoint what they are – for example, if sustainability is really important to you, spending your money on products and companies that support eco-friendly incentives and sustainability would be spending that aligns with your values.

Or perhaps you’re big on fitness and clean eating – investing in quality foods, a personal trainer or even exercise equipment are things that are going to benefit your health and promote a lifestyle that represents your values.

Investments are a great channel of financial self-care but you wouldn’t invest in oil if you’re an environmentalist! Put your money somewhere that you believe in.

4. Emergency Funds: Your Safety Net for Peace of Mind

Creating financial wellness starts with cultivating a feeling of security and, furthermore having a savings safety net. So having an emergency fund is a crucial part of financial wellness. In times of unexpected expenses, your emergency fund will cover those surprise costs without you having to worry about where you’re going to find the funds.

How much you have in your emergency fund is personal to you, but a common guideline is to save three to six months’ worth of living expenses. Whether it’s a medical emergency, car repairs, or a job loss, you’ll have that cushion to fall back on and you can make it through those unpleasant surprises without the stress and worry.

5. Invest in Yourself: Education for Financial Growth

Investments are always a good place to start when you’re looking at creating a better relationship with your finances and investing in yourself is no different. Self-investment through skill development and education is probably one of the most effective ways to ensure you’ll have a strong future with your finances. By investing money in improving your skill set and knowledge you’ll increase your potential to earn more and be a desirable pick when you apply for jobs.

Look into courses, workshops, certifications, or classes that’ll teach you in-demand skills in your industry or even a new industry. Whatever it may be, investing a portion of your budget into self-development will give your confidence a massive boost.

6. Regular Financial Check-Ins for Long-Term Wellness

Just like with any other changes you make in your life, monitoring the progress of those changes and having regular check-ins is essential to be sure that you’re on the right track.

Taking the time to pause and reflect on how far you’ve come will help you keep up those new money habits and hit the goals that you set. Set a schedule for your check-ins that’s realistic – it could be weekly, monthly, or quarterly but being consistent and honest with them is key.

Review your budget, look at the progress you’ve made towards the goals that you’ve set, and adjust them as you need – just because you’ve created a budget doesn’t mean it’s set in stone, so if it isn’t working for you or it’s not realistic then change it up! That’s what these reviews are for.

Keeping an eye on how all your new plans are going, will help you anticipate any upcoming expenses and have you feeling in control and relaxed because you’ve got a plan, savings, and a budget.

Pin these financial self-care tips for later!

Your Path to Financial Wellness

Achieving financial wellness isn’t just about the numbers. It’s revamping your mindset, looking at your existing money habits and limiting beliefs in addition to creating a relationship with money that actually reflects the things that you believe in.

Some of these steps take a little bit longer to prep, like a budget and investing in upskilling, but some of them can be implemented right away. You can practice gratitude right where you are! But it’s the little changes that add up and create all of the big ones, so take it easy on yourself and make one small change at a time.

Once you’ve gotten to a place where your finances are in order, the peace of mind and security you’ll get to experience will be well worth all of the journaling, spreadsheets, coursework, and budgeting. Money stress can really take its toll and affect you in so many different ways, so once you have it all under control, then you’ll be more present, have more freedom, feel more confident and feel empowered in your choices. All adding up to a more peaceful and fulfilled life – a win-win if you ask me!